Changes to the Customs Valuation for Duty Regulations Will Have an Impact on Indirect Taxes

The Canadian Border Services Agency (“CBSA”) published proposed amendments to the Valuation for Duty Regulations on May 27, 2023[1] that it says are intended to address an “unfair advantage” the current rules provide for non-resident importers (“NRIs”) and “level the playing field”. However, the effect of the proposed amendments appear be much broader.

Background

The value for duty of imported goods impacts the amount of goods and services tax (“GST”) payable on goods imported through the commercial stream and the harmonized sales tax (“HST”), Quebec sales tax (“QST”), provincial and retail sales tax (“PST”) imposed in British Columbia, Saskatchewan and Manitoba on goods imported through the casual stream. The impact of the amendments will be to increase the cost of imported goods to the extent the tax payable is not recoverable by the Canadian resident parties to the transactions.

The Agreement on Implementation of Article VII of the General Agreement on Tariffs and Trade 1994 of the World Trade Organization (the “WTO”), also referred to as the Customs Value Agreement (the “CVA”), establish a set of rules to govern the valuation of goods on importation into WTO member countries. Under the CVA, there are six methods, which are to be used in a hierarchical order to import goods into a member country; however, a key obligation under the CVA is for members to rely on the Transaction Value Method[2] as the primary basis for determining the value for duty.

In order to apply the Transaction Value Method for imports into Canada, the following three conditions under the Customs Act (“Canada”) must be satisfied:

- The imported goods are sold for export to Canada;

- The purchaser in the sale for export is a purchaser in Canada; and

- The price paid or payable for the goods can be determined. (emphasis added)

Currently, the term “sold for export to Canada” is not defined in the Customs Act. However, the term “purchaser in Canada” is defined in the current version of the Valuation for Duty Regulations as follows:

For the purposes of subsection 45(1) of the Act, purchaser in Canada means

- (a) a resident;

- (b) a person who is not a resident but who has a permanent establishment in Canada; or

- (c) a person who neither is a resident nor has a permanent establishment in Canada, and who imports the goods, for which the value for duty is being determined,

- (i)for consumption, use or enjoyment by the person in Canada, but not for sale, or

- (ii)for sale by the person in Canada, if, before the purchase of the goods, the person has not entered into an agreement to sell the goods to a resident.

Basis for the Proposed Amendments

According to the CBSA, as a result of certain court and Canadian International Trade Tribunal (“CITT”) decisions[3], NRIs, which are businesses located outside Canada that ship goods to customers in Canada, have an unfair advantage over Canadian businesses because they are able to use an earlier sale, such as a sale transaction between a foreign-based manufacturer and an NRI, rather than the sale to an actual buyer located in Canada that brought the goods into Canada to determine the value for duty. The CBSA also refers to subsidiaries of NRIs benefitting from the “unfair advantage”. According to the CBSA, the amendments to the Valuation for Duty Regulations seek to accomplish the following objectives:

- ensure that Canadian importers that compete with NRIs are not at a disadvantage as a result of the current regulatory framework, which allows the latter to declare a lower purchase price when calculating VFD;

- provide a legal basis to ensure the government collects duties on the sale that brought the goods to Canada, thereby preventing revenue leakage stemming from NRIs ability to declare an earlier sale in the supply chain;

- ensure that Canada meets its obligations under the CVA and to Canada’s trading partners regarding the methods of calculating VFD; and

- ensure that Canada fosters a fair and predictable environment for the trading community that is consistent with the objectives of free and liberalized trade and in compliance with the internationally agreed methods of calculating VFD.

The Proposed Amendments

The amendments to the Valuation for Duty Regulations introduce a definition of “sale for export” in section 2.01, which reads as follows:

(1) For the purposes of subsection 45(1) of the Act, sold for export to Canada means, in respect of goods, to be subject to an agreement, understanding or any other type of arrangement — regardless of its form — to be transferred, in exchange for payment, for the purpose of being exported to Canada, regardless of whether the transfer of ownership of the goods is completed before or after the goods are imported.

(2) If the goods are subject to two or more agreements, understandings or other types of arrangement described in subsection (1), the applicable agreement, understanding or arrangement for the purposes of that subsection is the one respecting the last transfer of the goods in the supply chain among the transfers under those agreements, understandings or arrangements, regardless of the order in which the agreements, understandings or arrangements were entered into.

The new definition of “sale for export” effectively reverses the Supreme Court of Canada decision in Mattel by removing the Court’s holding that the sale under which title transfers to the importer is the “sale for export”. In addition, one must look beyond agreements of sale and must now consider “an agreement, understanding or any other arrangement” in determining the “sale for export”. Subsection 2.01(2) specifically provides that when there is more than one agreement, understanding or arrangement, it is “the last transfer of the goods in the supply chain among the transfers under those agreements, understanding or arrangements…” The proposed amendments effectively enshrine the “last sale” rule into law, even where the last sale is a transaction after the goods have been introduced into Canada between two domestic Canadian persons.

The amendments also fundamentally change the definition of “purchaser in Canada” by eliminating residency/permanent establishment as factors. Instead the definition focuses on the person who purchases or will purchase the goods under the relevant agreement, understanding or any other type of arrangement referred to in section 2.01 irrespective of whether the person is the importer of the goods or when the person makes payments in respect of the goods. Proposed section 2.1 reads as follows:

For the purposes of subsection 45(1) of the Act, purchaser in Canada means, in respect of goods that are the subject of an agreement, understanding or any other type of arrangement referred to in section 2.01, the person who, under that agreement, understanding or arrangement, purchases or will purchase the goods, regardless of whether the person is the importer of the goods or when the person makes payments in respect of the goods.

Takeaways

There is a concern that the proposed amendments will have a broader impact than described, will discourage non-resident businesses from having a presence in Canada, create more uncertainty regarding the determination of the value for duty and increase the cost of goods to Canadian consumers. In general, unless goods are imported on speculation (i.e., there are no agreements, understandings or other types of arrangements for the sale of the goods prior to importation), the value for duty will generally be determined by the sale price on the last sale to a person in Canada, which may include a consumer even where there is a Canadian resident seller or distributor in the transaction change.

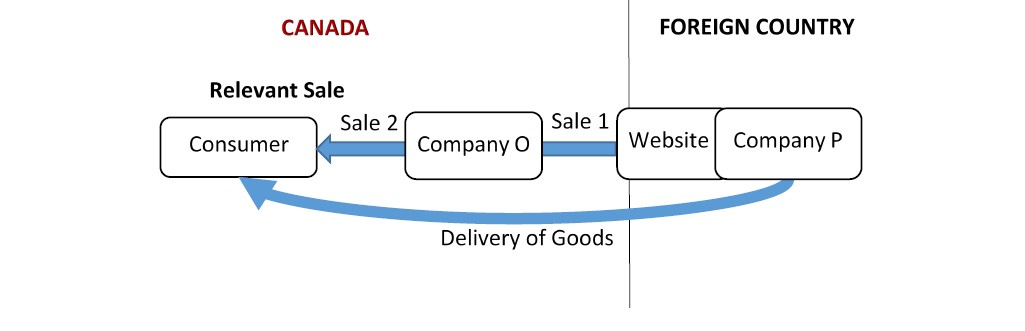

For example, the Regulatory Impact Analysis Statement provides the following Scenario showing that the sale price to determine the value for duty would be the sale price in a domestic Canadian transaction to a consumer:

A consumer in Canada places an order online and pays for goods through the website of company P, which is located in a foreign country. The website through which the order is placed is set up to represent company P’s related company O, a Canadian entity, to sell goods in Canada. The order placed through the website automatically generates two invoices at the same time: one from company P to its related company, company O, and another from company O to the consumer. The goods are the subject of two sales: (1) from company P to company O, and (2) from company P, through company O, to the consumer. Company P fills the order and ships the goods directly to the consumer. Company O pays company P for the goods and also pays company P a fee for online services.

Both sales are considered to have occurred prior to importation. The order from the consumer sets off the chain of events that cause the goods to be exported to Canada and is the last sale in the supply of the goods to Canada. Therefore, it is sale 2 from company P, through company O, to the consumer that would be considered the sale for export to Canada and it is the price to the Canadian consumer that would be used as the basis to determine the transaction value of the imported goods.[4] (emphasis added)

Our International Trade and Investment Law Group has prepared a Client Alert regarding the proposed amendments that discusses the trade implications of these amendments. The CBSA is inviting comments on the proposed amendments until June 26, 2023. Businesses that import goods into Canada need to consider the proposed new rules and the impact of the rules on their supply chain and value for duty used on the importation of goods into Canada. Our indirect tax, customs and trade experts would be pleased to assist you in determining how the proposals may affect your business and ways to address you may address this.

***

[1] Canada Gazette, Part I, Volume 157, Number 21.

[2] Under the Transaction Value Method, the value for duty is based upon the price paid or payable for the goods, which is generally shown on the invoice, with adjustments for certain elements, such as certain royalties, commissions and transportation costs.

[3]The CBSA referred to Canada (Deputy Minister of National Revenue) v. Mattel Canada Inc., 2001 SCC 36 (CanLII), [2001] 2 SCR 100; CITT (ARCHIVED) AP-2004-009, Cherry Stix Ltd. v. President of the CBSA (Cherry Stix I); CITT (ARCHIVED) AP-2008-028, Cherry Stix Ltd. v. President of the CBSA (Cherry Stix II); and CITT (ARCHIVED) AP-2005-053, Ferragamo U.S.A. Inc. v. President of the CBSA. More recent decisions including Delta Galil USA Inc. v CBSA [2021] ETC 4521 further entrench this interpretation of “sale for export to Canada”

[4] Scenario 6 of the Regulatory Impact Analysis Statement